Stopping Safe Account Scams with Video

No Safe Account Scams in testing

Stable NPS

Someone in deep with a scammer is so hard for a Bank to engage. This trial popped an emotive, eye catching video to people whose payments were paused for checks. It gave vital confidence to open up future experiments. You can get customers to do more mid-payment and maintain good Customer Experience.

Designed to break through

Surprise and engaging visuals breakthrough during moments where other warnings can't

Opens up opportunity

Showed well designed friction can work in payment journeys without damaging customer experience

"Impersonation can be so tough for colleagues. New ideas like this will make a big difference - it helps get the customer back in the room."

Hannah | Service Designer| Santander

The Challenge

Scams where Customers have been coached to hide intentions present real challenges to Fraud contact centres. Safe account scams are a prime example. Hours of coaching can turn innocents into theatrical wonders, convinced that people are out to get their money. Agents are the last line of defence during a paused, suspicious payment. But scammers convince they are to be kept in the dark. How might we breakthrough before a scammed customer reaches an Agent?

The Future

Higher tech, visual and unusual interventions triggered for suspicious payments. Personalised, pushed and seamlessly integrated in payment journeys.

Outcomes

Stable NPS supports use at scale in Payment journeys

Methods used

How Behaviour Science and Design combined to stop scams

Discovery

Data and Insight

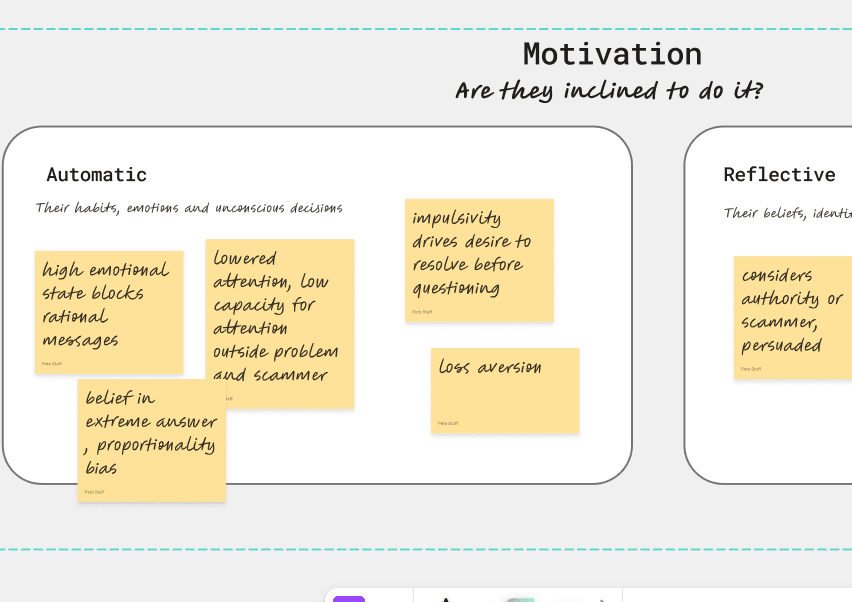

Behaviour modelling with 'COM - B'

Observation and Simulation

Scams Psychology Research

Using COM-B and journey mapping gave a great picture of what influenced people during safe account scams. This combined with insights from Pete's Masters level research paper into scam psychology.

A Behaviour Audit canvas was used to bring this and other quantitative and qualitative insight together in one place. Volumes of scams missed by contact centre, demographic and financial behavioural data were added. Call listening and qualitative research to capture different 'safe account' Modus Operandi too. This gave a strong picture of how, who and how much.

These were refined to a set of core insights, in the style of Ideo's Design Thinking method. An example would be "Agents are the last line of defence, but customers are convinced they can't be trusted"

These insights gave the launchpad for grounded ideation on what next.

Design and Prototyping

Design Thinking : Ideation

Behaviour Design

Lofi Prototyping

Design and Prototyping were very interwoven here.

First a combination of solo and small group ideation among Designers, to pull out as many ideas as possible. These were refined down into a shortlist using impact-effort prioritisation. Then Designers separated to work up prototypes and bring them back for quick friend and family testing to evaluate and refine.

One of these ideas was the safe account video. The original prototype was built by Pete in Powerpoint in an hr. This was played in mock scenarios to colleagues and family, to assess ability to grab attention, and the speed of comprehension based on language and terms used

Stage two was to collaborate with Andrew, a skilled part-time Video Producer from another team. Andrew gave the video enough polish for Live testing with real customers.

Testing and Delivery

Hifi Prototyping

Test Design

Jobs to be Done

Continuous Discovery

The Continuous Discovery and Delivery approach used at Roll and Flow is simple. Bring something viable into a real life environment early, safely. Measure, learn, improve. That's what was used here.

The speediest route to test the Video was not perfect. But it was live with real customers. It's essential to measure any impact on real behaviour. No amount of simulation can replicate true behaviour under the spell of a scam.

We needed to trigger the Video in response to a payment interruption. For the test a group Pete improvised. The Customer Engagement team came on board, and their Near-Real Time email provided the delivery mechanism. Call centre colleagues would then target specific calls, and signpost the Video. Very low tech, but a massive source of learning and confidence.

Near-real time wasn't real-time enough to scale. However this test opened to door to more experiments, and at greater scale. We showed that whether genuine payment or scam the intervention did not harm customer experience.

View more Case Studies

See how others Protected their Customers with Behaviour Science and Service Design

Contact

Roll & Flow : Prevent

Stop scams with Science wired into every step

© 2025 Tamashii Design Ltd. All rights reserved. Roll & Flow and Roll & Flow : Prevent are trading names of Tamashii Design Ltd, registered in England and Wales (No. 16294814).

.